Biden’s Student Loan Debt Relief Explained -- Application, Eligibility, Dates

Higher education opens doors for many Americans to pursue career aspirations and land well-paying jobs. For individuals from low- and middle-income families, however, such opportunity often comes with a hefty price – student loan debt.

The typical undergraduate student with loans now graduates with nearly $25,000 in educational debt, according to analysis by the U.S. Department of Education. Paying back the amount borrowed (plus interest) can be a struggle, especially during times of economic crisis.

The scenario is especially problematic for the nearly one-third of borrowers who have debt but dropped out of college before earning a degree. They owe money but lack the credentials to qualify for jobs with salaries that would lessen the burden of repayment.

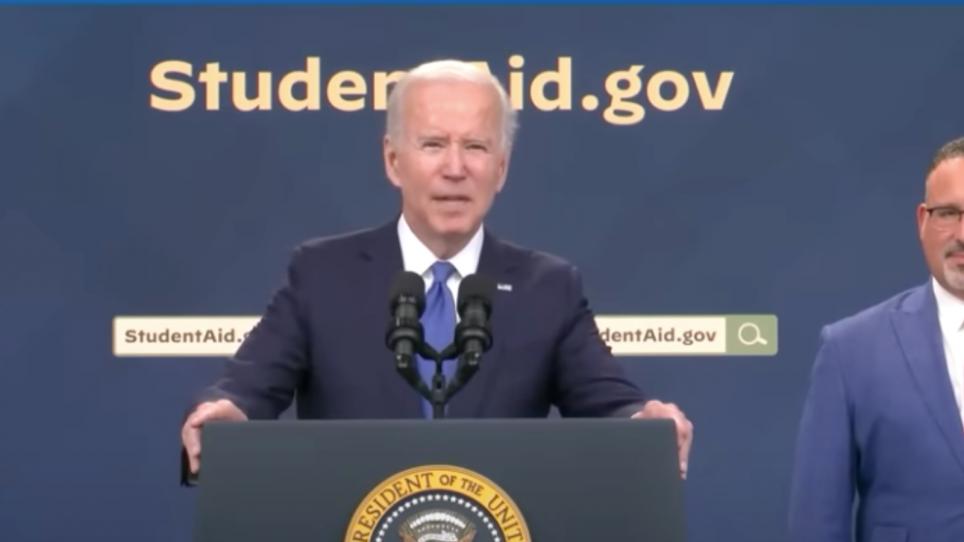

President Joseph Biden’s student loan debt relief plan is part of an overall effort to address the strain of growing college costs and ease some of the burden experienced by borrowers. It comes at a time when many people are experiencing problems making ends meet in the aftermath of the COVID-19 pandemic.

This article aims to answer key questions that borrowers are currently asking about Biden’s student loan relief program. Use it as a guide to determine your eligibility and the corresponding next steps.

Biden’s One-Time Student Loan Debt Relief Explained

Biden’s plan offers the chance for eligible student loan holders to receive a full or partial discharge – up to $20,000 for Federal Pell Grant recipients and up to $10,000 for non-Pell Grant recipients. This loan forgiveness is not an ongoing activity. Individuals have from now until December 31, 2023, to submit their one-time application.

The Biden Administration urges applying to the relief program by November 15, 2022. Why? As you might be aware, a student loan pause has been in effect since March 13, 2020, because of the pandemic. It will expire on December 31, 2022. At that time, repayment obligations resume. Getting your relief form in by the suggested date allows time for processing and determining your remaining payments (if any) going forward.

Note that the one-time student loan debt relief won’t be taxed at the federal level. Some states, however, may tax the money. It is important for all who take part in this program to check information for their state of residence when tax season comes.

How Much Student Loan Debt Will Be Forgiven?

White House projections show more than 40 million borrowers eligible for the student-debt relief plan. Nearly 20 million borrowers could see their entire remaining balance discharged.

How much do you stand to have knocked off your student loan debt? Recipients fall into one of two categories:

-

If you received a Federal Pell Grant in college and meet the relief plan’s income requirement of less than $125,000 for an individual or $250,000 for a married couple, you can get up to $20,000 in debt relief.

-

If you did not receive a Federal Pell Grant in college but took out loans held by the Department of Education, you can get up to $10,000 in debt relief provided you meet the plan’s income limits of $125,000 for an individual or $250,000 for a married couple.

Depending on your loan balance, the relief payment could cover the full amount. If, say, you still owe $9,000 and are eligible for $10,000 in debt relief, you’ll receive $9,000 in relief.

Many people still will carry a loan balance after the one-time debt relief gets applied. For instance, someone with a loan balance of $15,000 who receives $10,000 in debt relief still must pay the remaining $5,000. The loan servicer will recalculate monthly payment based on this new balance.

Some Americans kept up their student loan payments during the pandemic pause even though they were not required to do so. They might find themselves currently in a situation where their remaining loan balance is less than what they are eligible to now receive in debt relief. Don’t worry. This voluntary diligence will not end up costing them money. Rather, they can receive refunds on student loan payments made during that period from March 13, 2020 to December 31, 2022, up to the remaining amount of eligible debt relief.

Who Qualifies for the $10K-$20K Student Loan Debt Forgiveness?

The Biden Administration designed the relief plan to aid people most likely in need of assistance to reduce their student debt. To that end, they established income requirements.

Income Eligibility

Look at the IRS Tax Form 1040 that you filed in 2021 or 2020. Find your Adjusted Gross Income (AGI) on line 11. If you are single or if you are married but you and your spouse filed taxes separately, this number needs to be less than $125,000 to qualify for student debt relief. If you are married filing jointly, head of household, or a qualifying widow(er), this number must be less than $250,000 to qualify. Note that you need to meet the income criteria for either 2020 or 2021, but you do not need to meet it for both years.

Current students with loans are eligible for debt relief, too.

However, debt relief applies only to loan balances existing before June 30, 2022. Any new loans disbursed on or after July 1, 2022, are not eligible for debt relief. Also, the relief eligibility of a student classified as a dependent on someone else’s tax return will be based on parental income rather than his or her own income.

List of the Loans Eligible for Forgiveness/Relief

Since federal undergraduate, graduate, and Parent PLUS loans are all eligible for relief, a variety of people stand to benefit. The following types of federal student loans disbursed on or before June 30, 2022, are eligible for relief:

- William D. Ford Federal Direct Loan (Direct Loan) Program loans

- Federal Family Education Loan (FFEL) Program loans held by the Department of Education (ED) or in default at a guaranty agency

- Federal Perkins Loan Program loans held by ED

- Defaulted loans (includes ED-held or commercially serviced Subsidized Stafford, Unsubsidized Stafford, parent PLUS, graduate PLUS; and Perkins loans held by ED)

- FFEL and Perkins Loans not owned by the ED that you applied to consolidate into the federal direct loan program before September 29, 2022.

These Loans Are Not Eligible for Bident’s One-Time Student Loan Relief Program

The relief program only applies to federally-backed student loans. The following are NOT eligible:

- Student loans from private banks and lenders

- Federal loans consolidated with a private lender

- Federal student loans not held by the Department of Education that were consolidated into federal direct loans after September 29, 2022

Application for Student Loan Debt Relief – What to Expect

Applying for debt relief is an easy, straightforward process that takes roughly five minutes online. (A paper version is forthcoming for those who prefer that method.) You will not need to log in or provide any documents.

Rather, simply be prepared to give the following:

- Your name

- Your social security number

- Your date of birth

- Your phone number

- Your email address

Then, read the statements attesting to your eligibility based on income. Sign the document, check the box to certify that the information you provided is true and correct, and submit. The Education Department’s Federal Student Aid office will review the application and match with the borrowers’ federal records to confirm eligibility.

How to Apply for Student Loan Debt Relief -- 10 Steps

Ready to take part in Biden’s one-time student loan debt relief program? Here is what you need to do:

Note that most borrowers will receive debt relief only if they submit an application. However, if you completed a Free Application for Federal Student Aid (FAFSA) form for the 2022–23 school year or are enrolled in an income-driven repayment plan based on your 2020 or 2021 income, you may be eligible for relief without applying. The Department of Education will email borrowers who qualify for debt relief without applying to tell them that they won’t need to apply to receive debt relief.

How Is Biden’s One-Time Student Loan Relief Different from Public Service Student Loan Forgiveness Programs?

Regardless of their occupation, many Americans stand to gain from the Biden Administration’s one-time student loan relief program. A different program, however, can provide additional assistance to public servants.

The Public Service Loan Forgiveness Program (PSLF) provides student debt forgiveness to those who have worked at least 10 years for any U.S. federal, state, local, or tribal government agency. This includes employers such as the U.S. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts (such as public transportation, water, and housing authorities). The PSLF Program forgives the remaining balance on someone’s Direct Loans after he or she has made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

For a limited time, borrowers may receive credit for payments that previously did not qualify for PSLF. To learn more, check out Federal Student Aid’s webpage on limited PSLF waivers. But act quickly. You must apply before October 31, 2022.

Beware of Scams

Participating in the one-time student loan relief program is a free and relatively easy process. Unfortunately, many mischievous individuals and organizations out there profit on potential recipients thinking otherwise. They may tout services to help you navigate the “complex” process – essentially charging you for free information or stealing personal information such as your social security number when they “file” on your behalf.

Know that you never have to pay for help with your federal student aid. Work only with the U.S. Department of Education and its loan servicers. And remember that nobody will ever ask for your Federal Student Aid (FSA) ID password.

Apply for relief through this one site only: https://studentaid.gov/debt-relief/application.

Look carefully at any emails you receive. Legit ones come from noreply@studentaid.gov, noreply@debtrelief.studentaid.gov, or ed.gov@public.govdelivery.com.

Learn More about Student Loan Debt Forgiveness

If you still have questions or would like to learn more about one-time student loan debt relief, the following governmental sites can help:

- StudentAid.gov

- Fact Sheet: President Biden Announces Student Loan Relief for Borrowers Who Need It Most

- U.S. Department of Education

- The Biden-Harris Administration’s Student Debt Relief Plan Explained

Stay up to date with our college updates, news, advice, and more.